Preparing Numerical Data#

Note

Install ekorpkit package first. Set logging level to Warning, if you don’t want to see verbose logging,

%config InlineBackend.figure_format='retina'

import logging

from ekorpkit import eKonf

logging.basicConfig(level=logging.WARNING)

print(eKonf.__version__)

0.1.33+20.g8433774.dirty

data_dir = "../data/fomc"

Load FOMC class#

cfg = eKonf.compose("io/fetcher/fomc")

cfg.output_dir = data_dir

fomc = eKonf.instantiate(cfg)

print(fomc)

<ekorpkit.io.fetch.fomc.base.FOMC object at 0x7f6b4a296820>

Chairpersons#

fomc.chairpersons

| last_name | first_name | from_date | to_date | |

|---|---|---|---|---|

| 0 | Volcker | Paul | 1979-08-06 | 1987-08-10 |

| 1 | Greenspan | Alan | 1987-08-11 | 2006-01-31 |

| 2 | Bernanke | Ben | 2006-02-01 | 2014-01-31 |

| 3 | Yellen | Janet | 2014-02-03 | 2018-02-03 |

| 4 | Powell | Jerome | 2018-02-05 | 2022-06-26 |

Load Calendar#

fomc.load_calendar(from_year=1982, force_download=False)

| unscheduled | forecast | confcall | speaker | rate | rate_change | rate_decision | rate_changed | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 1982-10-05 | False | False | False | Paul Volcker | 9.50 | -0.50 | -1.0 | 1 |

| 1982-11-16 | False | False | False | Paul Volcker | 9.00 | -0.50 | -1.0 | 1 |

| 1982-12-21 | False | False | False | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-14 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-21 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-11-03 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2021-12-15 | False | True | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-01-26 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-03-16 | False | True | False | Jerome Powell | 0.50 | 0.25 | 1.0 | 1 |

| 2022-05-04 | False | False | False | Jerome Powell | 1.00 | 0.50 | 1.0 | 1 |

415 rows × 8 columns

fomc_calendar = fomc.calendar.copy()

fomc_calendar

| unscheduled | forecast | confcall | speaker | rate | rate_change | rate_decision | rate_changed | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 1982-10-05 | False | False | False | Paul Volcker | 9.50 | -0.50 | -1.0 | 1 |

| 1982-11-16 | False | False | False | Paul Volcker | 9.00 | -0.50 | -1.0 | 1 |

| 1982-12-21 | False | False | False | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-14 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-21 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-11-03 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2021-12-15 | False | True | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-01-26 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-03-16 | False | True | False | Jerome Powell | 0.50 | 0.25 | 1.0 | 1 |

| 2022-05-04 | False | False | False | Jerome Powell | 1.00 | 0.50 | 1.0 | 1 |

415 rows × 8 columns

Load Market Data#

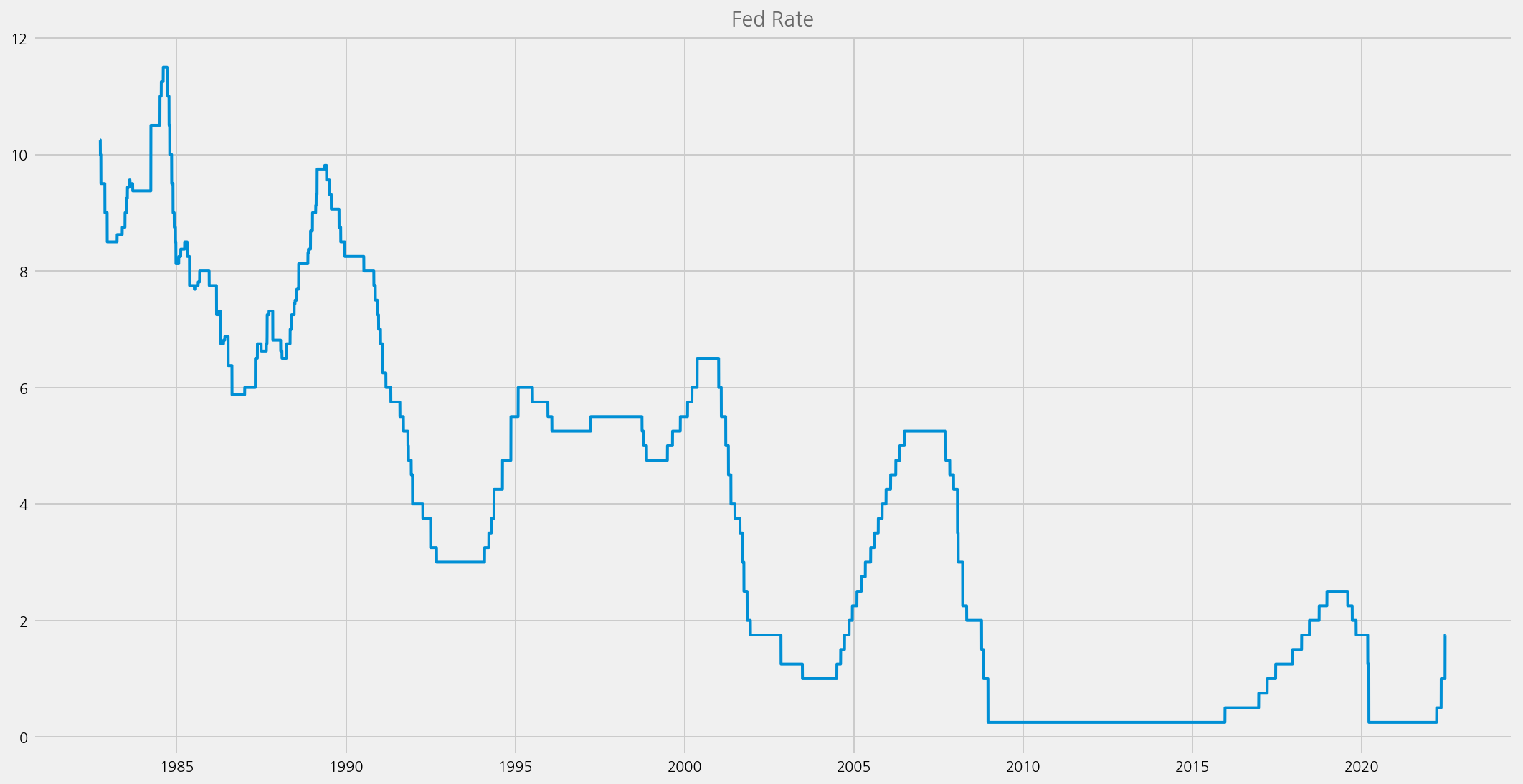

Target FED Rate#

cfg = eKonf.compose("io/fetcher=quandl")

cfg.series_name = "DFEDTAR"

cfg.series_id = ["DFEDTAR", "DFEDTARU"]

# cfg.force_download = True

quandl = eKonf.instantiate(cfg)

fedrates = quandl.data.copy()

fedrates

| DFEDTAR | series_id | |

|---|---|---|

| date | ||

| 1982-09-27 | 10.25 | DFEDTAR |

| 1982-09-28 | 10.25 | DFEDTAR |

| 1982-09-29 | 10.25 | DFEDTAR |

| 1982-09-30 | 10.25 | DFEDTAR |

| 1982-10-01 | 10.00 | DFEDTAR |

| ... | ... | ... |

| 2022-06-15 | 1.00 | DFEDTARU |

| 2022-06-16 | 1.75 | DFEDTARU |

| 2022-06-17 | 1.75 | DFEDTARU |

| 2022-06-18 | 1.75 | DFEDTARU |

| 2022-06-19 | 1.75 | DFEDTARU |

14511 rows × 2 columns

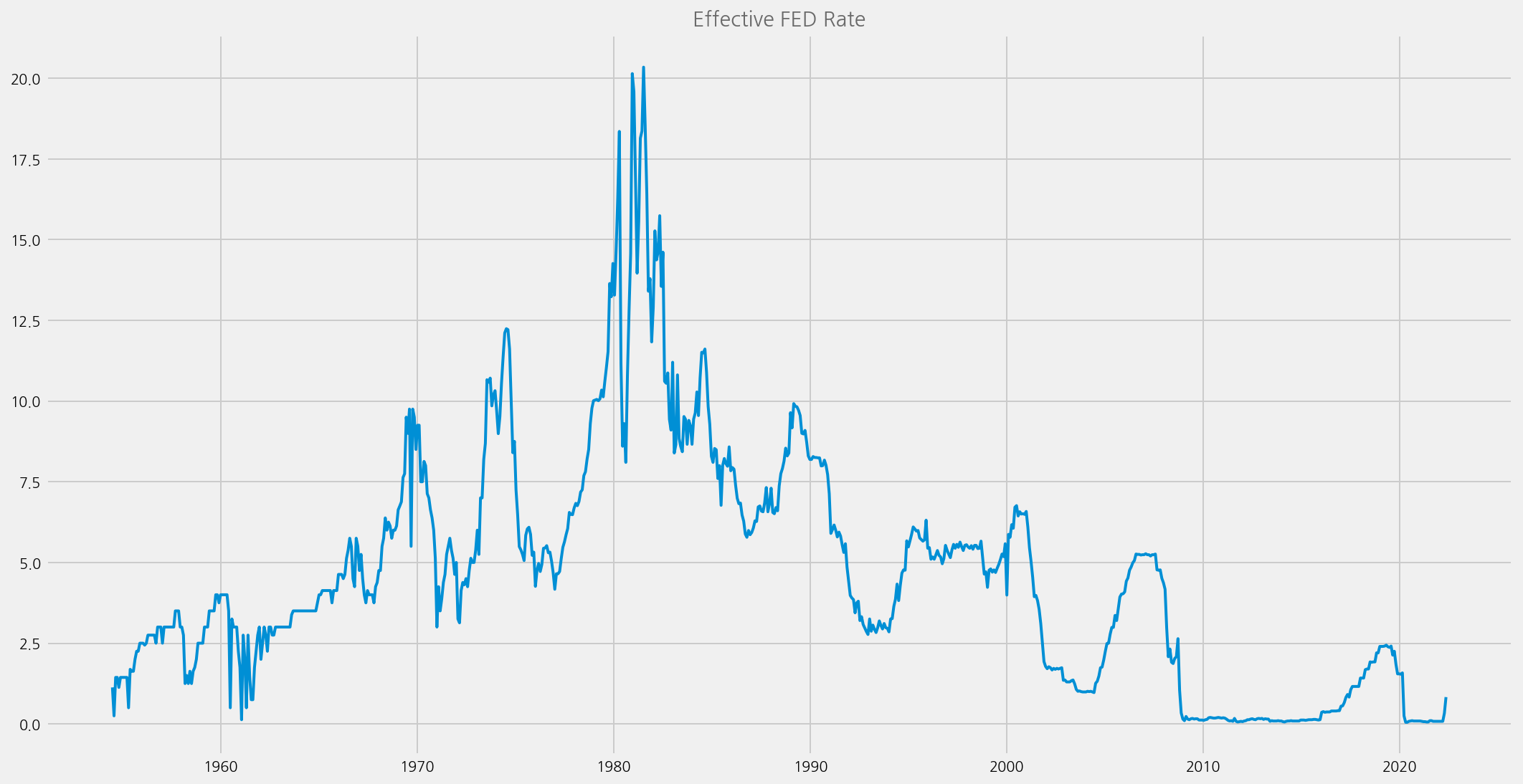

Effective FED Rate#

dff = quandl.load(series_id="DFF")

dff

| DFF | |

|---|---|

| date | |

| 1954-07-01 | 1.13 |

| 1954-07-02 | 1.25 |

| 1954-07-03 | 1.25 |

| 1954-07-04 | 1.25 |

| 1954-07-05 | 0.88 |

| ... | ... |

| 2022-05-20 | 0.83 |

| 2022-05-21 | 0.83 |

| 2022-05-22 | 0.83 |

| 2022-05-23 | 0.83 |

| 2022-05-24 | 0.83 |

24800 rows × 1 columns

Load Economic Indices#

import pandas as pd

from tqdm import tqdm

econ_indicators = {}

# quandl.force_download = True

for name, sr in tqdm(fomc.econ_series.items()):

econ_indicators[sr["name"]] = quandl.load(

series_id=sr["id"], series_name=sr["name"], expressions=sr["expressions"]

)

100%|██████████| 10/10 [00:00<00:00, 440.36it/s]

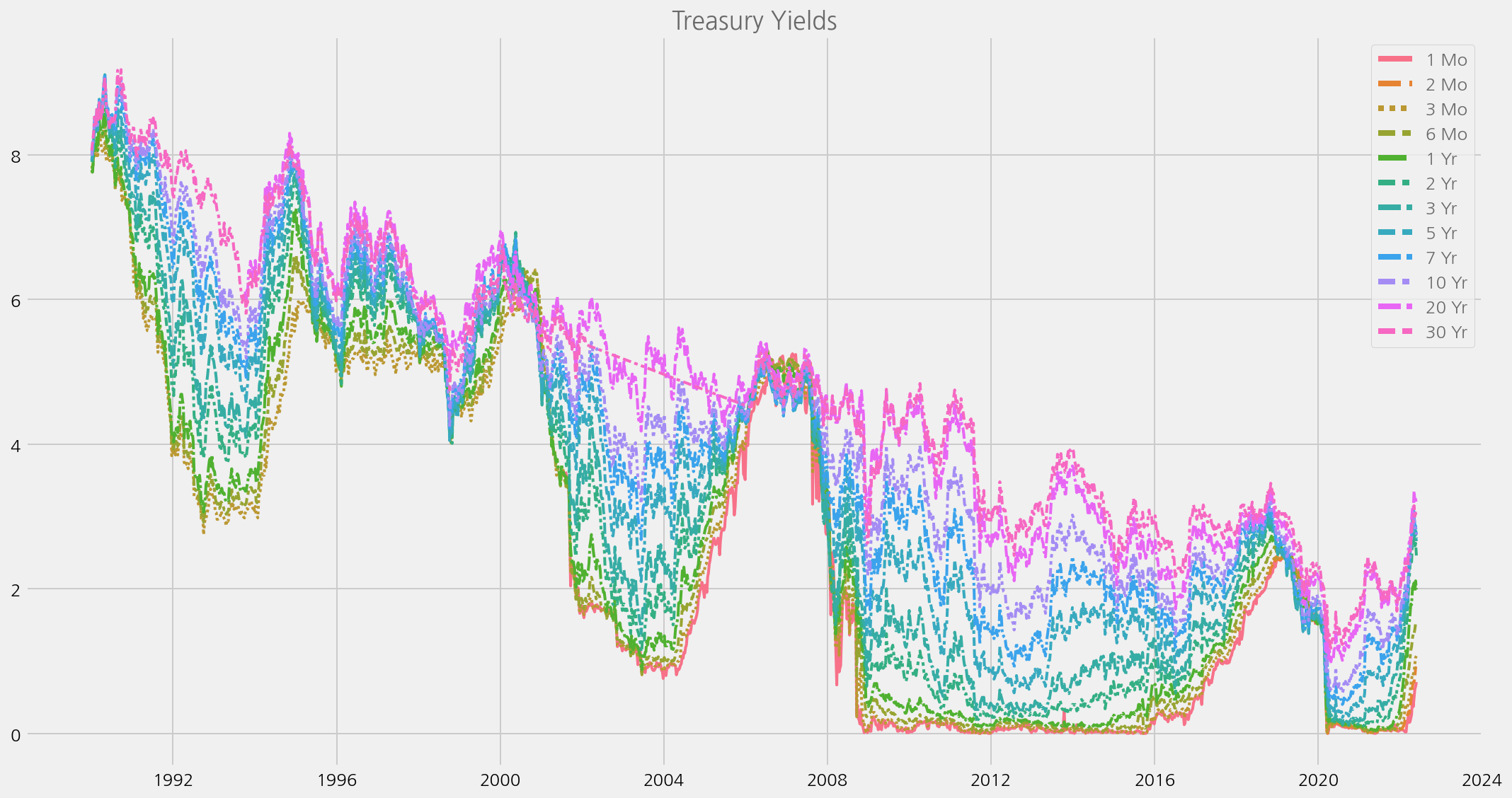

Treasury Yield#

Getting from US Treasury Site as xml#

import pandas as pd

treasury_yield_url = "https://home.treasury.gov/resource-center/data-chart-center/interest-rates/daily-treasury-rates.csv/all/all?type=daily_treasury_yield_curve&field_tdr_date_value=all&data=yieldAll&page&_format=csv"

treasury = pd.read_csv(treasury_yield_url)

treasury['Date'] = pd.to_datetime(treasury['Date'])

treasury.set_index('Date', inplace=True)

treasury

Add Rate and Decisions#

fomc.add_decisions_to_calendar(fedrates)

fomc_calendar = fomc.calendar.copy()

fomc_calendar

100%|██████████| 427/427 [00:00<00:00, 1196.43it/s]

| unscheduled | forecast | confcall | speaker | rate | rate_change | rate_decision | |

|---|---|---|---|---|---|---|---|

| date | |||||||

| 1982-10-05 | False | False | False | Paul Volcker | 9.50 | -0.50 | -1.0 |

| 1982-11-16 | False | False | False | Paul Volcker | 9.00 | -0.50 | -1.0 |

| 1982-12-21 | False | False | False | Paul Volcker | 8.50 | 0.00 | 0.0 |

| 1983-01-14 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 |

| 1983-01-21 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-11-03 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 |

| 2021-12-15 | False | True | False | Jerome Powell | 0.25 | 0.00 | 0.0 |

| 2022-01-26 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 |

| 2022-03-16 | False | True | False | Jerome Powell | 0.50 | 0.25 | 1.0 |

| 2022-05-04 | False | False | False | Jerome Powell | 1.00 | 0.50 | 1.0 |

414 rows × 7 columns

Though this is not perfect as Target Rate was sometimes changed between FOMC meetings, enough to analyze the impact of FOMC Meetings.

Add Quantitative Easing as a Lower event#

Between 2008 and 2016 saw zero interest rate. Main monetary measure shifted to quantity from rate. Thus, add “lower” events when those QE was announced.

fomc.add_unconventionals_to_calendar()

fomc_calendar = fomc.calendar.copy()

fomc_calendar

| unscheduled | forecast | confcall | speaker | rate | rate_change | rate_decision | rate_changed | |

|---|---|---|---|---|---|---|---|---|

| date | ||||||||

| 1982-10-05 | False | False | False | Paul Volcker | 9.50 | -0.50 | -1.0 | 1 |

| 1982-11-16 | False | False | False | Paul Volcker | 9.00 | -0.50 | -1.0 | 1 |

| 1982-12-21 | False | False | False | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-14 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| 1983-01-21 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-11-03 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2021-12-15 | False | True | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-01-26 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 |

| 2022-03-16 | False | True | False | Jerome Powell | 0.50 | 0.25 | 1.0 | 1 |

| 2022-05-04 | False | False | False | Jerome Powell | 1.00 | 0.50 | 1.0 | 1 |

415 rows × 8 columns

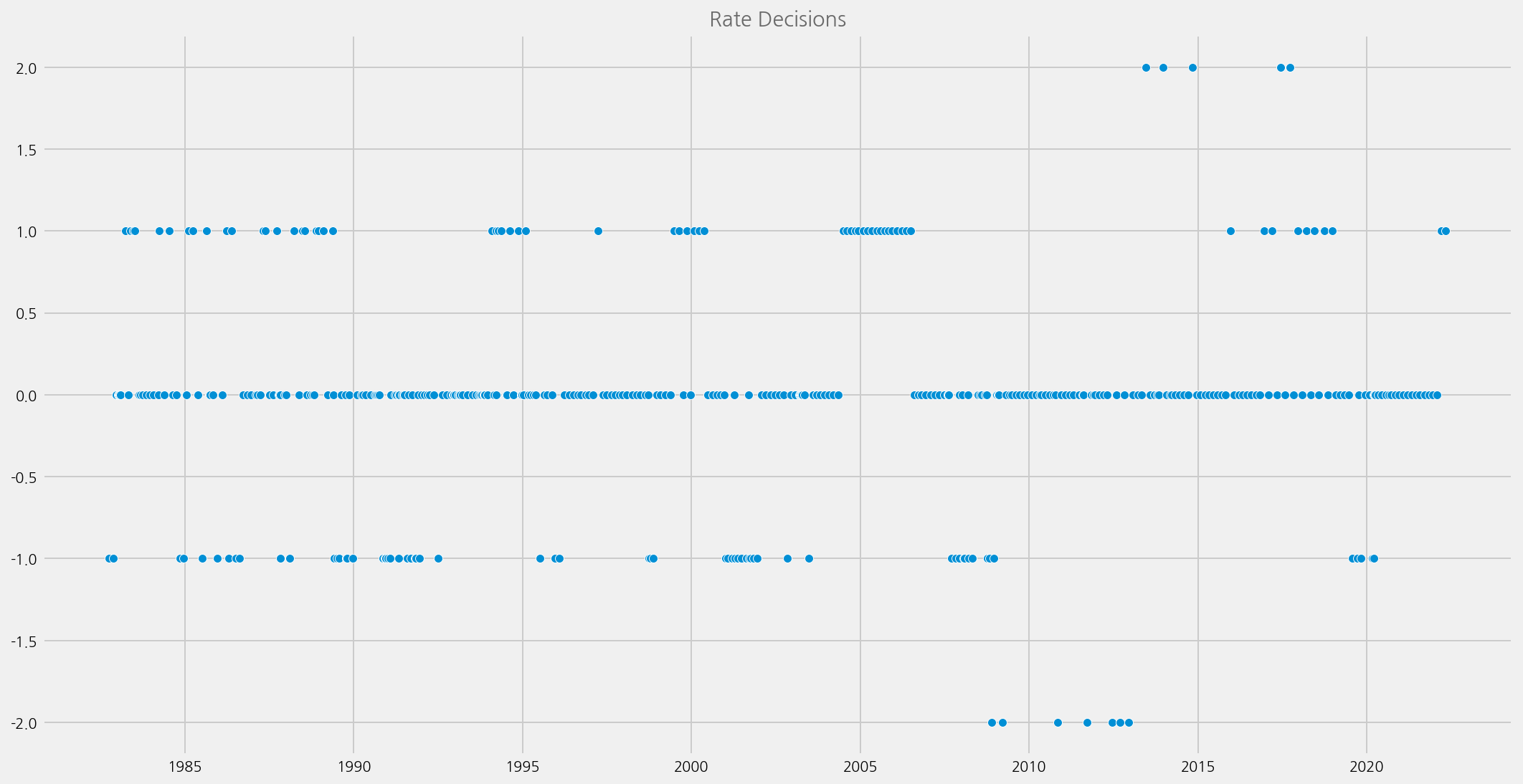

cfg = eKonf.compose("visualize/plot=scatterplot")

cfg.plot.y = "rate_decision"

cfg.figure.figsize = (15, 8)

cfg.ax.title = "Rate Decisions"

eKonf.instantiate(cfg, data=fomc_calendar)

econ_data = eKonf.load_data("econ_data.parquet", data_dir)

if econ_data is not None:

print(econ_data.tail())

unscheduled forecast confcall speaker rate rate_change \

date

2021-11-03 False False False Jerome Powell 0.25 0.00

2021-12-15 False True False Jerome Powell 0.25 0.00

2022-01-26 False False False Jerome Powell 0.25 0.00

2022-03-16 False True False Jerome Powell 0.50 0.25

2022-05-04 False False False Jerome Powell 1.00 0.50

rate_decision rate_changed GDP GDP_diff_prev ... \

date ...

2021-11-03 0.0 0 19478.893 0.570948 ...

2021-12-15 0.0 0 19478.893 0.570948 ...

2022-01-26 0.0 0 19478.893 0.570948 ...

2022-03-16 1.0 1 19806.290 1.680778 ...

2022-05-04 1.0 1 19735.895 -0.355417 ...

NMI_diff_year NMI_date RSALES RSALES_diff_prev \

date

2021-11-03 9.440559 2021-09-01 230078.0 0.573951

2021-12-15 20.422535 2021-11-01 231485.0 -0.098829

2022-01-26 7.972270 2021-12-01 226467.0 -2.167743

2022-03-16 1.073345 2022-02-01 233062.0 0.847674

2022-05-04 -6.270096 2022-03-01 234776.0 0.568863

RSALES_diff_year RSALES_date HSALES HSALES_diff_prev \

date

2021-11-03 8.474656 2021-09-01 732.0 6.705539

2021-12-15 10.977142 2021-11-01 756.0 12.667660

2022-01-26 9.101289 2021-12-01 839.0 10.978836

2022-03-16 9.076698 2022-02-01 792.0 -4.693141

2022-05-04 -0.034915 2022-04-01 591.0 -16.643159

HSALES_diff_year HSALES_date

date

2021-11-03 -26.135217 2021-09-01

2021-12-15 -11.163337 2021-11-01

2022-01-26 -3.673938 2021-12-01

2022-03-16 3.125000 2022-02-01

2022-05-04 -26.946848 2022-04-01

[5 rows x 48 columns]

econ_data = fomc_calendar.copy()

for name, sr in fomc.econ_series.items():

offset = sr["relativedelta"]

columns = [name, name + "_diff_prev", name + "_diff_year"]

econ_data = fomc.add_available_latest(

econ_data, econ_indicators[name], name, columns, offset

)

eKonf.save_data(econ_data, "econ_data.parquet", data_dir)

100%|██████████| 415/415 [00:00<00:00, 1187.39it/s]

100%|██████████| 415/415 [00:00<00:00, 1201.06it/s]

100%|██████████| 415/415 [00:00<00:00, 1202.73it/s]

100%|██████████| 415/415 [00:00<00:00, 1209.28it/s]

100%|██████████| 415/415 [00:00<00:00, 1211.78it/s]

100%|██████████| 415/415 [00:00<00:00, 1206.54it/s]

100%|██████████| 415/415 [00:00<00:00, 1190.50it/s]

100%|██████████| 415/415 [00:00<00:00, 2298.93it/s]

100%|██████████| 415/415 [00:00<00:00, 1514.60it/s]

100%|██████████| 415/415 [00:00<00:00, 1198.11it/s]

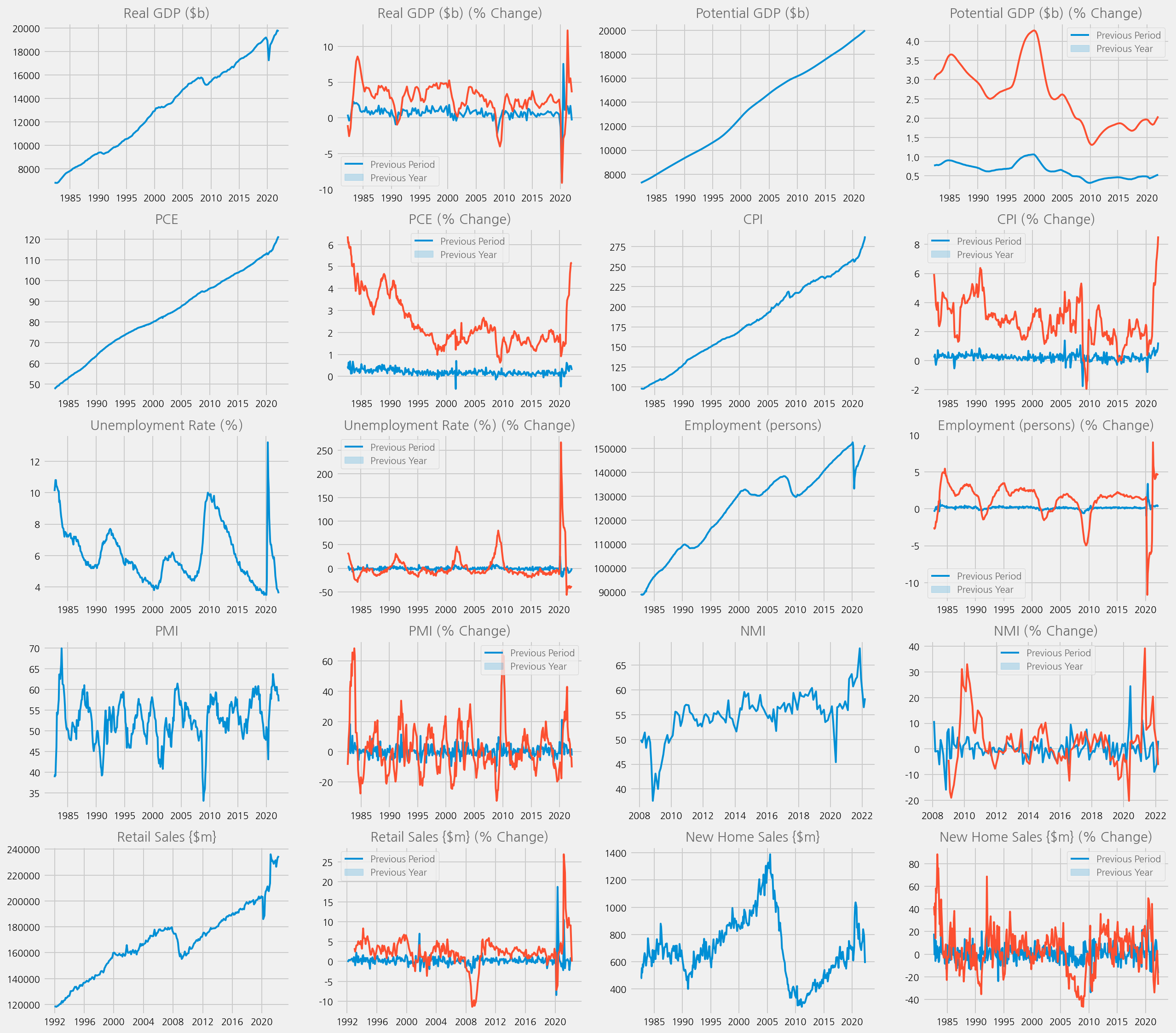

cfg = eKonf.compose("visualize/plot=lineplot")

cfg.figure.figsize = (18,16)

cfg.figure.fontsize = 10

cfg.subplots.ncols = 4

cfg.subplots.nrows = 5

lineplot = cfg.lineplot.copy()

ax = cfg.ax.copy()

cfg.plots = []

cfg.axes = []

for i, sr in enumerate(fomc.econ_series.values()):

name = sr["name"]

title = sr["title"]

plot = lineplot.copy()

plot.x = name + "_date"

plot.y = name

plot.axno = i*2

cfg.plots.append(plot)

_ax = ax.copy()

_ax.title = title

_ax.axno = i*2

cfg.axes.append(_ax)

_ax = ax.copy()

_ax.title = title + " (% Change)"

_ax.legend = ['Previous Period', 'Previous Year']

_ax.axno = i*2+1

cfg.axes.append(_ax)

plot = lineplot.copy()

plot.x = name + "_date"

plot.y = name + "_diff_prev"

plot.axno = i*2+1

cfg.plots.append(plot)

plot = lineplot.copy()

plot.x = name + "_date"

plot.y = name + "_diff_year"

plot.axno = i*2+1

cfg.plots.append(plot)

eKonf.instantiate(cfg, data=econ_data)

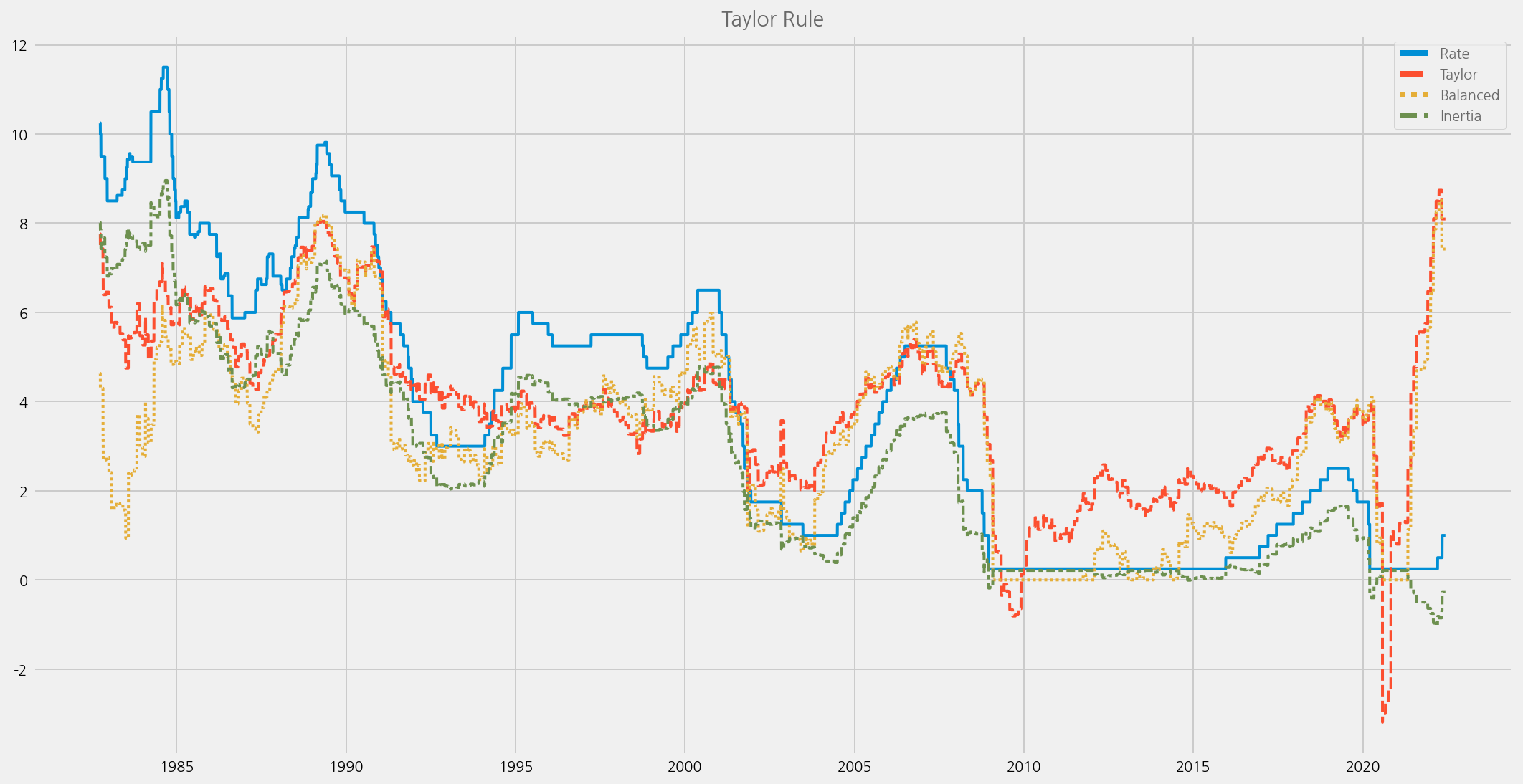

Add Taylor Rule#

As FED has released how policymakers use these data here, try to calculate them and use instead of raw data.

https://www.federalreserve.gov/monetarypolicy/policy-rules-and-how-policymakers-use-them.htm

# Create taylor dataframe

taylor = fedrates.copy()

for name in ['GDP', 'GDPPOT', 'PCE']:

sr = fomc.econ_series[name]

offset = sr["relativedelta"]

columns = [name, name + "_diff_prev", name + "_diff_year"]

taylor = fomc.add_available_latest(

taylor, econ_indicators[name], name, columns, offset

)

100%|██████████| 14501/14501 [00:12<00:00, 1207.01it/s]

100%|██████████| 14501/14501 [00:11<00:00, 1238.34it/s]

100%|██████████| 14501/14501 [00:11<00:00, 1208.64it/s]

import numpy as np

# Obtain available index used to calculate Taylor rule each day

taylor["Y"] = taylor["GDP"]

taylor["Yp"] = taylor["GDPPOT"]

taylor["Y-Yp"] = (np.log(taylor["Y"] * 10 ** 9) - np.log(taylor["Yp"] * 10 ** 9)) * 100

taylor["Pi"] = taylor["PCE_diff_year"]

taylor["Pi*"] = 2

taylor["Pi-Pi*"] = taylor["Pi"] - taylor["Pi*"]

taylor["r"] = 2

taylor["Rate"] = taylor["DFEDTAR"]

# Calculate Taylor Rule

taylor['Taylor'] = taylor['r'] + taylor['Pi'] + 0.5 * taylor['Pi-Pi*'] + 0.5 * taylor['Y-Yp']

# Calculate Balanced-approach Rule

taylor['Balanced'] = (taylor['r'] + taylor['Pi'] + 0.5 * taylor['Pi-Pi*'] + taylor['Y-Yp']).map(lambda x: 0 if x < 0 else x)

# Calculate Inertia Rule

taylor['Inertia'] = 0.85 * taylor['Rate'] - 0.15 * taylor['Balanced']

# Keey necessary columns only

taylor = taylor[['Rate', 'Taylor', 'Balanced', 'Inertia']]

cfg = eKonf.compose("visualize/plot=lineplot")

cfg.plot.y = list(taylor.columns)

cfg.figure.figsize = (15, 8)

cfg.ax.title = "Taylor Rule"

eKonf.instantiate(cfg, data=taylor)

taylor = taylor.copy()

# Deviation from Rate, which may trigger the rate change

taylor['Taylor-Rate'] = taylor['Taylor'] - taylor['Rate']

taylor['Balanced-Rate'] = taylor['Balanced'] - taylor['Rate']

taylor['Inertia-Rate'] = taylor['Inertia'] - taylor['Rate']

taylor['Taylor_diff'] = taylor['Taylor'].diff(1)

taylor['Balanced_diff'] = taylor['Balanced'].diff(1)

taylor['Inertia_diff'] = taylor['Inertia'].diff(1)

taylor.tail()

| Rate | Taylor | Balanced | Inertia | Taylor-Rate | Balanced-Rate | Inertia-Rate | Taylor_diff | Balanced_diff | Inertia_diff | |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 2022-06-05 | 1.0 | 8.094924 | 7.420939 | -0.263141 | 7.094924 | 6.420939 | -1.263141 | 0.0 | 0.0 | 0.0 |

| 2022-06-06 | 1.0 | 8.094924 | 7.420939 | -0.263141 | 7.094924 | 6.420939 | -1.263141 | 0.0 | 0.0 | 0.0 |

| 2022-06-07 | 1.0 | 8.094924 | 7.420939 | -0.263141 | 7.094924 | 6.420939 | -1.263141 | 0.0 | 0.0 | 0.0 |

| 2022-06-08 | 1.0 | 8.094924 | 7.420939 | -0.263141 | 7.094924 | 6.420939 | -1.263141 | 0.0 | 0.0 | 0.0 |

| 2022-06-09 | 1.0 | 8.094924 | 7.420939 | -0.263141 | 7.094924 | 6.420939 | -1.263141 | 0.0 | 0.0 | 0.0 |

taylor2 = taylor.copy()

taylor2.reset_index(inplace=True)

taylor2['date'] = taylor2['date'].shift(-1)

econ_data2 = econ_data.reset_index().merge(taylor2, on='date', how='left')

econ_data2.set_index('date', inplace=True)

eKonf.save_data(econ_data2, "econ_data2.parquet", data_dir)

econ_data2

| unscheduled | forecast | confcall | speaker | rate | rate_change | rate_decision | rate_changed | GDP | GDP_diff_prev | ... | Rate | Taylor | Balanced | Inertia | Taylor-Rate | Balanced-Rate | Inertia-Rate | Taylor_diff | Balanced_diff | Inertia_diff | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 1982-10-05 | False | False | False | Paul Volcker | 9.50 | -0.50 | -1.0 | 1 | 6830.251 | 0.456199 | ... | 10.00 | 7.428054 | 4.300007 | 7.854999 | -2.571946 | -5.699993 | -2.145001 | 0.0 | 0.0 | 0.0 |

| 1982-11-16 | False | False | False | Paul Volcker | 9.00 | -0.50 | -1.0 | 1 | 6804.139 | -0.382299 | ... | 9.50 | 6.397952 | 2.690992 | 7.671351 | -3.102048 | -6.809008 | -1.828649 | 0.0 | 0.0 | 0.0 |

| 1982-12-21 | False | False | False | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 | 6804.139 | -0.382299 | ... | 8.50 | 6.456348 | 2.749388 | 6.812592 | -2.043652 | -5.750612 | -1.687408 | 0.0 | 0.0 | 0.0 |

| 1983-01-14 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 | 6804.139 | -0.382299 | ... | 8.50 | 6.117343 | 2.410384 | 6.863442 | -2.382657 | -6.089616 | -1.636558 | 0.0 | 0.0 | 0.0 |

| 1983-01-21 | False | False | True | Paul Volcker | 8.50 | 0.00 | 0.0 | 0 | 6804.139 | -0.382299 | ... | 8.50 | 6.117343 | 2.410384 | 6.863442 | -2.382657 | -6.089616 | -1.636558 | 0.0 | 0.0 | 0.0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-11-03 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 | 19478.893 | 0.570948 | ... | 0.25 | 5.747177 | 4.940210 | -0.528532 | 5.497177 | 4.690210 | -0.778532 | 0.0 | 0.0 | 0.0 |

| 2021-12-15 | False | True | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 | 19478.893 | 0.570948 | ... | 0.25 | 6.472329 | 5.665362 | -0.637304 | 6.222329 | 5.415362 | -0.887304 | 0.0 | 0.0 | 0.0 |

| 2022-01-26 | False | False | False | Jerome Powell | 0.25 | 0.00 | 0.0 | 0 | 19478.893 | 0.570948 | ... | 0.25 | 7.222928 | 6.415961 | -0.749894 | 6.972928 | 6.165961 | -0.999894 | 0.0 | 0.0 | 0.0 |

| 2022-03-16 | False | True | False | Jerome Powell | 0.50 | 0.25 | 1.0 | 1 | 19806.290 | 1.680778 | ... | 0.25 | 8.499377 | 8.267766 | -1.027665 | 8.249377 | 8.017766 | -1.277665 | 0.0 | 0.0 | 0.0 |

| 2022-05-04 | False | False | False | Jerome Powell | 1.00 | 0.50 | 1.0 | 1 | 19735.895 | -0.355417 | ... | 0.50 | 8.094924 | 7.420939 | -0.688141 | 7.594924 | 6.920939 | -1.188141 | 0.0 | 0.0 | 0.0 |

415 rows × 58 columns