Monetary Policy Shocks#

Christiano, Lawrence J., Martin Eichenbaum, and Charles L. Evans. 1999. “Monetary Policy Shocks: What Have We Learned and to What End?”

%config InlineBackend.figure_format='retina'

from ekorpkit import eKonf

eKonf.setLogger("WARNING")

print("version:", eKonf.__version__)

print("is notebook?", eKonf.is_notebook())

print("is colab?", eKonf.is_colab())

print("evironment varialbles:")

eKonf.print(eKonf.env().dict())

INFO:ekorpkit.base:IPython version: (6, 9, 0), client: jupyter_client

INFO:ekorpkit.base:Google Colab not detected.

version: 0.1.35+0.g69734d6.dirty

is notebook? True

is colab? False

evironment varialbles:

{'CUDA_DEVICE_ORDER': None,

'CUDA_VISIBLE_DEVICES': None,

'EKORPKIT_CONFIG_DIR': '/workspace/projects/ekorpkit-book/config',

'EKORPKIT_DATA_DIR': None,

'EKORPKIT_LOG_LEVEL': 'WARNING',

'EKORPKIT_PROJECT': 'ekorpkit-book',

'EKORPKIT_WORKSPACE_ROOT': '/workspace',

'KMP_DUPLICATE_LIB_OK': 'TRUE',

'NUM_WORKERS': 230}

start_year = 1999

data_dir = "../data/fomc"

eKonf.env().FRED_API_KEY

pydantic.types.SecretStr

import numpy as np

ids = {

"GDPC1": "Real GDP",

"PCECC96": "Real Consumption",

"GDPDEF": "GDP Deflator",

"GPDIC1": "Real investment",

"COMPRNFB": "Real wage",

"OPHNFB": "Labor productivity",

"FEDFUNDS": "Federal funds rate",

"CP": "Real profit",

"M2SL": "M2 Growth",

"SP500": "SP500",

"CPIAUCSL": "CPI",

}

cols = list(ids.keys())

cfg = eKonf.compose("io/fetcher=quandl")

cfg.series_name = "value"

cfg.series_id = cols

# cfg.force_download = True

quandl = eKonf.instantiate(cfg)

econ_data = quandl.data.reset_index()

cfg = eKonf.compose("pipeline/pivot")

cfg.index = "date"

cfg.columns = "series_id"

cfg.values = ["value"]

econ_data_pivot = eKonf.pipe(econ_data, cfg)

econ_data_pivot = econ_data_pivot.set_index("date").resample("Q").last()

cols.remove("M2SL")

econ_data_pivot[cols] = np.log(econ_data_pivot[cols])

econ_data_pivot["M2SL"] = econ_data_pivot.M2SL.pct_change()

econ_data_pivot

INFO:ekorpkit.base:Applying pipe: functools.partial(<function pivot at 0x7f4a921e4af0>)

| series_id | COMPRNFB | CP | CPIAUCSL | FEDFUNDS | GDPC1 | GDPDEF | GPDIC1 | M2SL | OPHNFB | PCECC96 | SP500 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||

| 1946-03-31 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1946-06-30 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1946-09-30 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1946-12-31 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1947-03-31 | 3.578618 | 3.089678 | 3.091042 | NaN | 7.617981 | 2.480899 | 5.384912 | NaN | 3.144712 | 7.152613 | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2021-06-30 | 4.746253 | 7.897441 | 5.601953 | -2.525729 | 9.871394 | 4.765698 | 8.162235 | 0.030493 | 4.723513 | 9.522638 | 8.365789 |

| 2021-09-30 | 4.745236 | 7.908976 | 5.613909 | -2.525729 | 9.877087 | 4.780089 | 8.191378 | 0.026018 | 4.713495 | 9.527514 | 8.368122 |

| 2021-12-31 | 4.751225 | 7.901128 | 5.635240 | -2.525729 | 9.893755 | 4.797343 | 8.269513 | 0.023429 | 4.728865 | 9.533753 | 8.469300 |

| 2022-03-31 | 4.739937 | 7.910851 | 5.661946 | -1.609438 | 9.889790 | 4.817172 | 8.281742 | 0.015165 | 4.709791 | 9.538284 | 8.418568 |

| 2022-06-30 | NaN | NaN | 5.674951 | -0.261365 | NaN | NaN | NaN | -0.002513 | NaN | NaN | 8.238902 |

306 rows × 11 columns

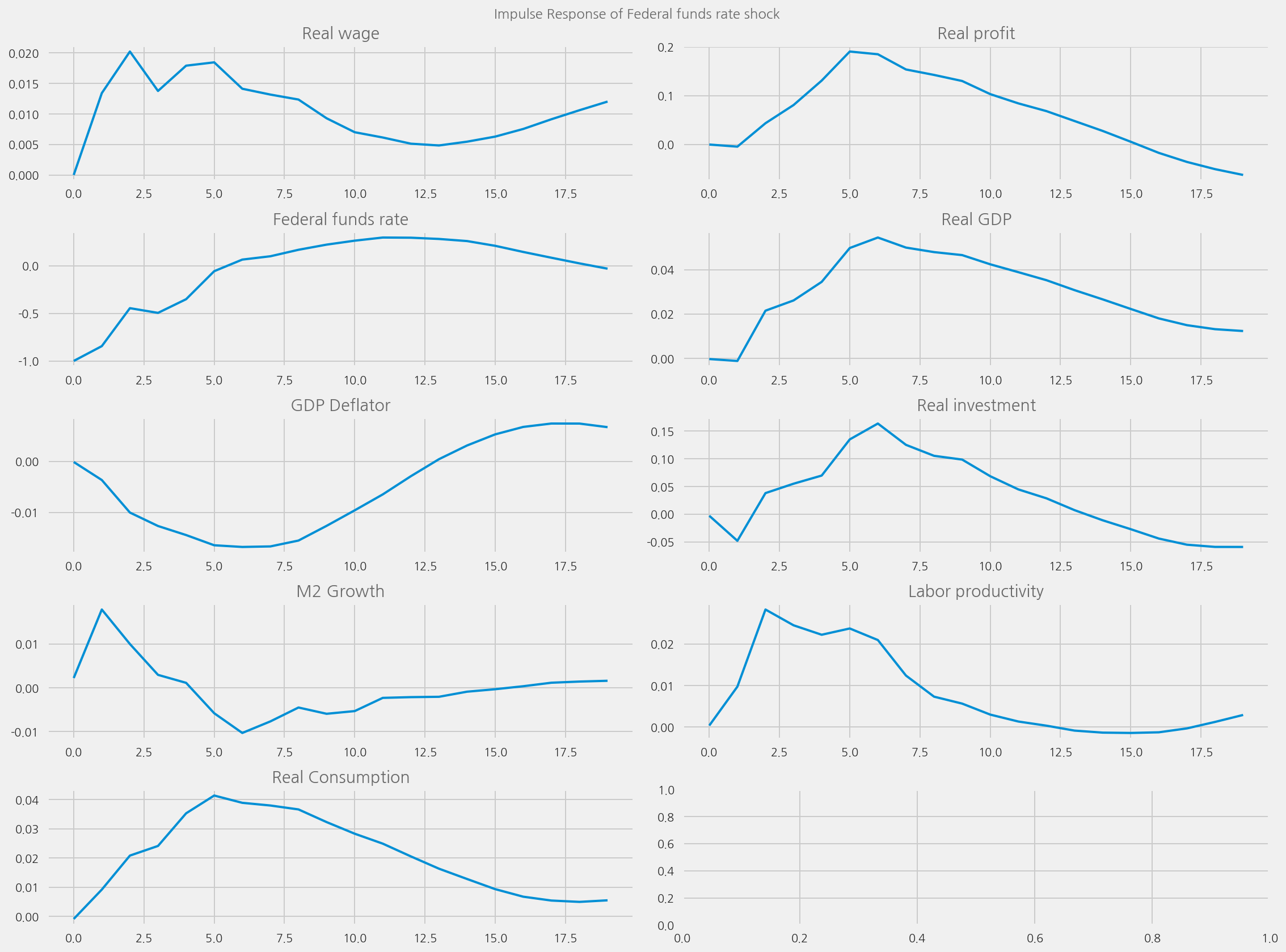

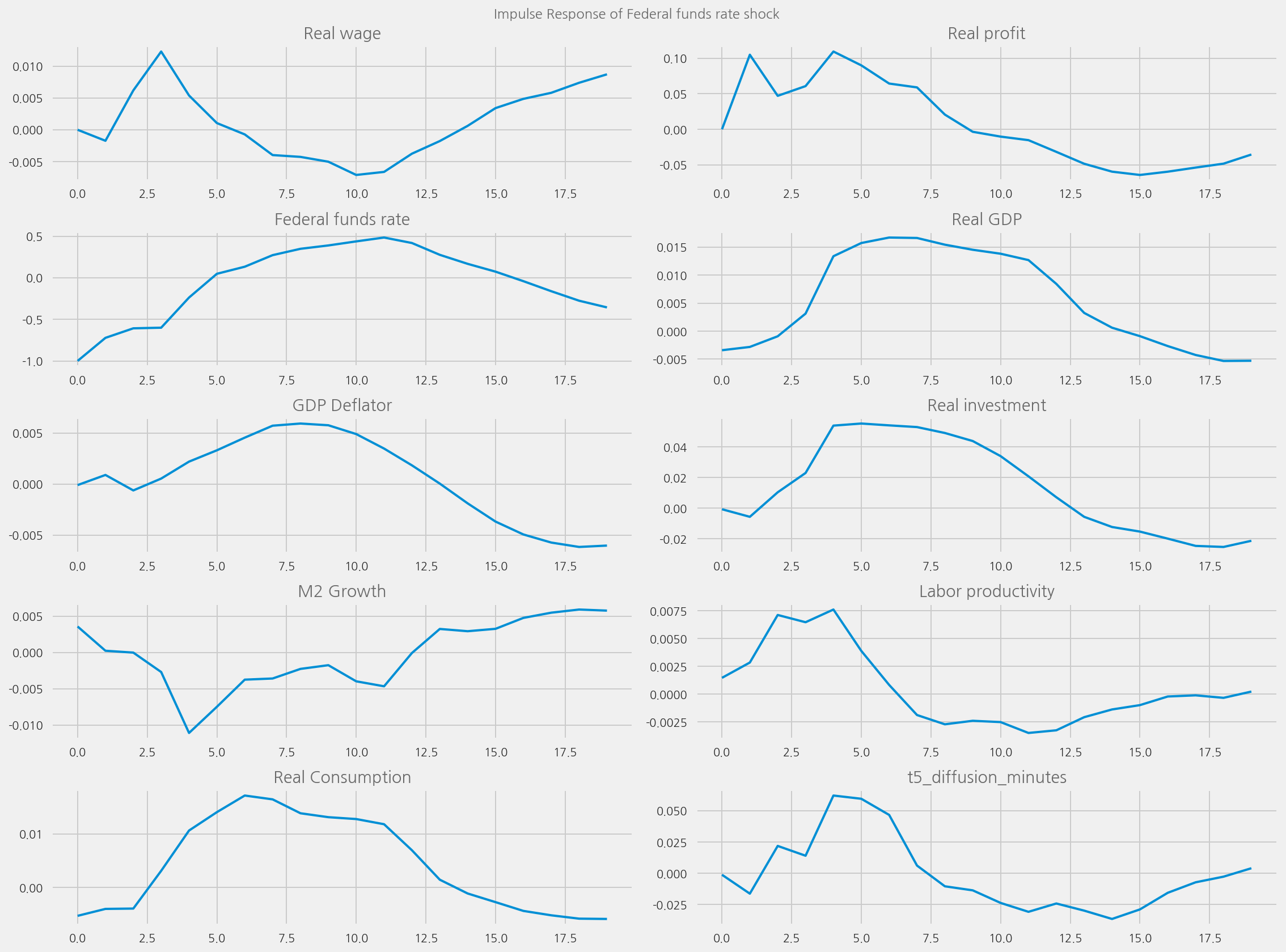

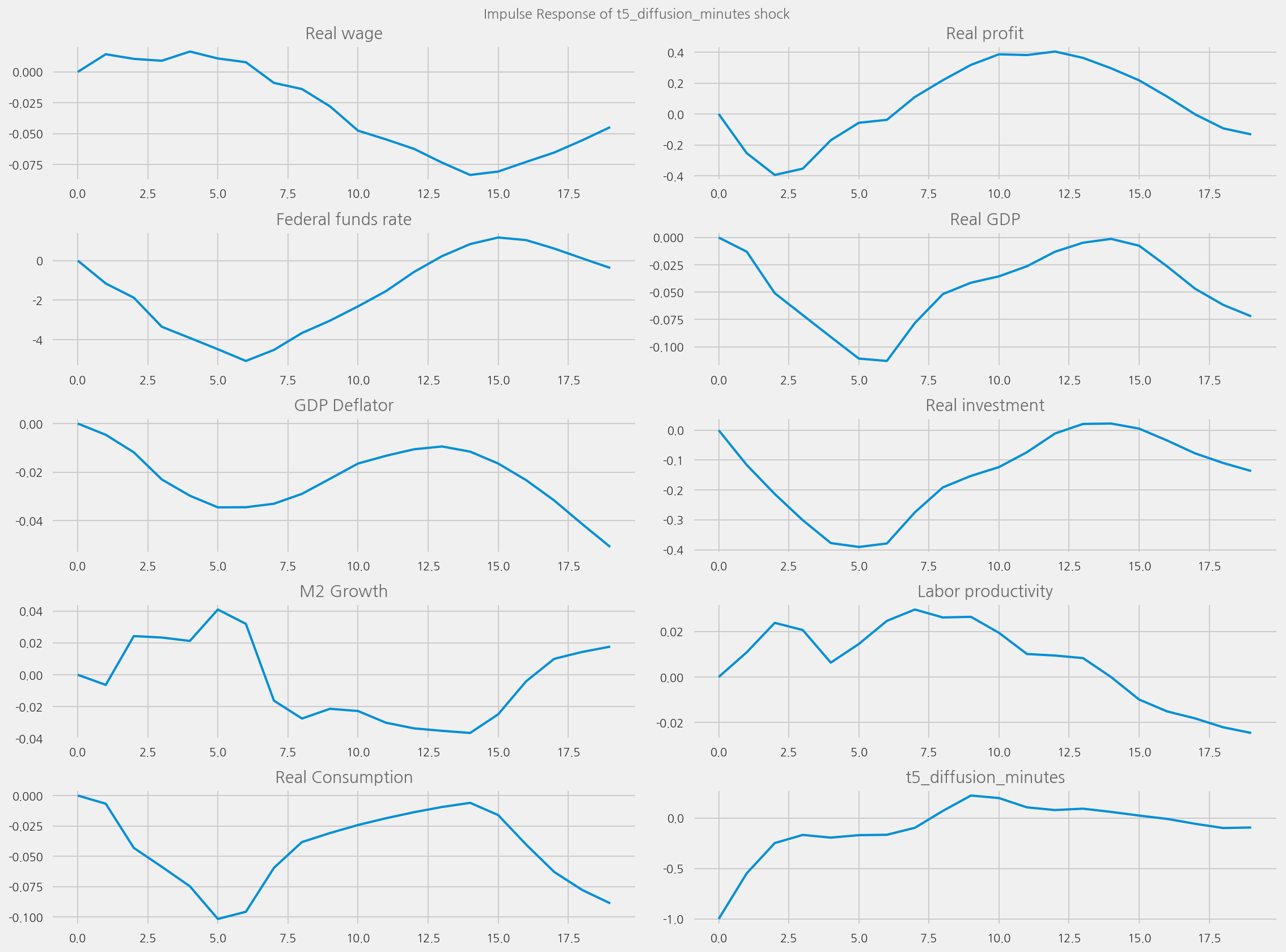

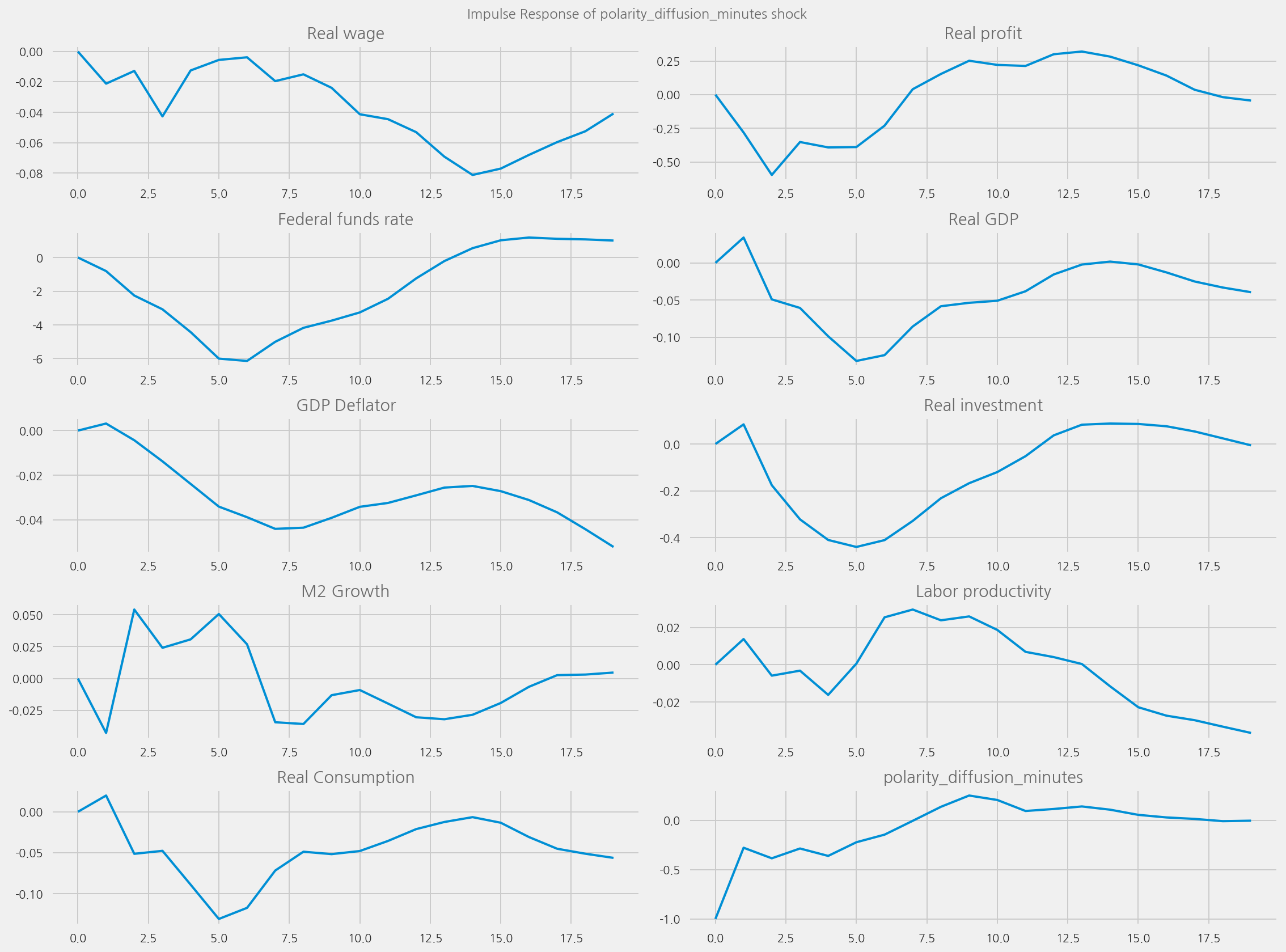

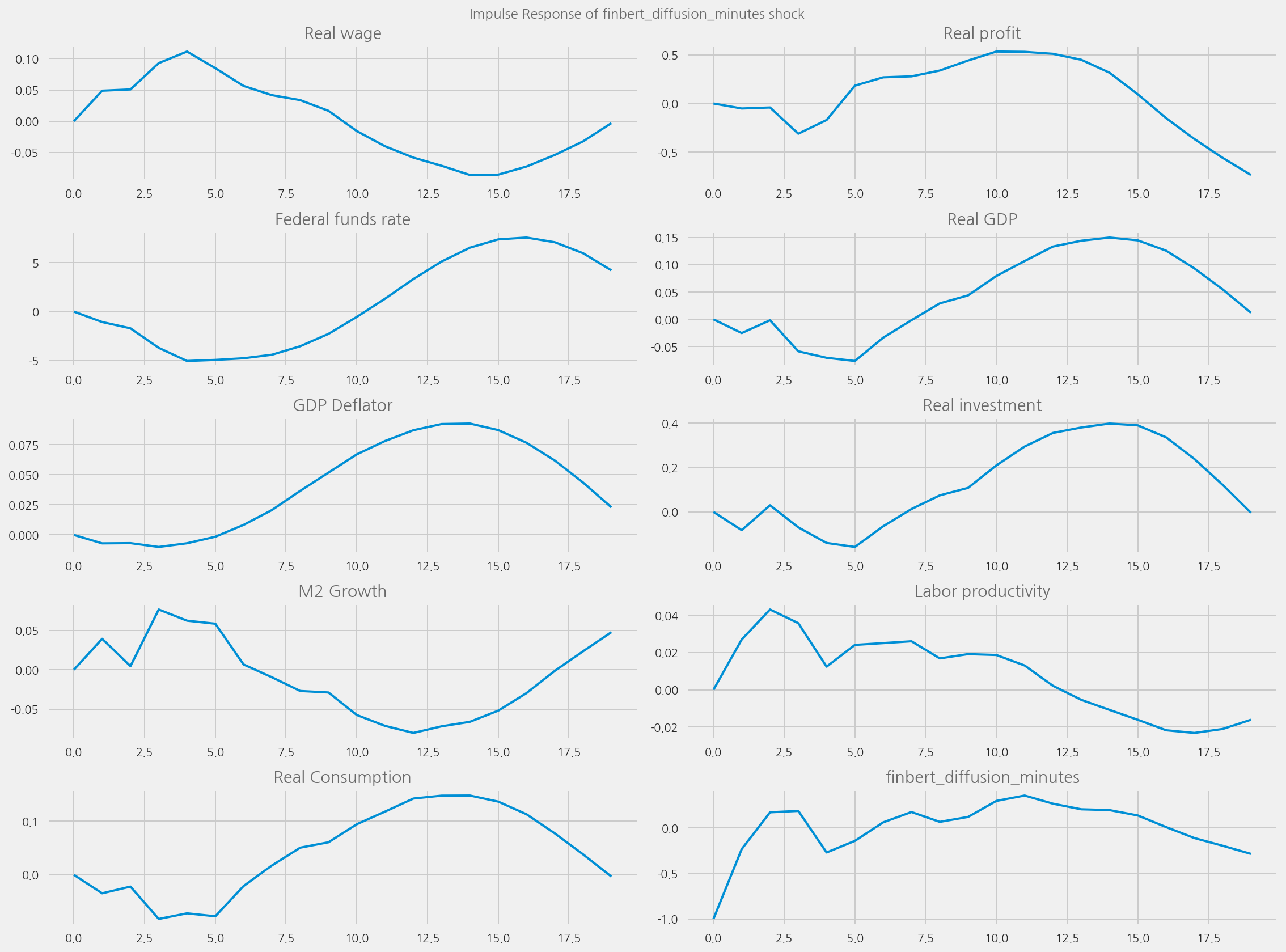

def plot_irfs(

from_year=1990,

to_year=2021,

shock_name="Federal funds rate",

tone_col=None,

econ_cols=[

"COMPRNFB",

"CP",

"FEDFUNDS",

"GDPC1",

"GDPDEF",

"GPDIC1",

"M2SL",

"OPHNFB",

"PCECC96",

],

):

_data = econ_data_pivot[

(econ_data_pivot.index.year >= from_year)

& (econ_data_pivot.index.year <= to_year)

].copy()

_data = _data[econ_cols]

_names = {col: ids[col] for col in econ_cols}

_data.rename(columns=_names, inplace=True)

if tone_col in fomc_train_tones.columns:

f_tone_data = fomc_train_tones[[tone_col]].dropna()

tones_q = f_tone_data.resample("Q").mean()

_data = _data.merge(

tones_q[[tone_col]].ffill(), left_index=True, right_index=True

)

irfs = fomc.get_irf(_data)

if shock_name:

fomc.plot_irf(irfs, shock_name)

if tone_col in _data.columns:

fomc.plot_irf(irfs, tone_col)